How Chinese Bar Stool Factories Can Outcompete Vietnam & Win Back U.S. Market Share Despite 20% U.S.-Vietnam Tariffs

The U.S. has imposed a 20% tariff on Vietnamese furniture imports, leveling the playing field for Chinese manufacturers. While Vietnam has been a strong competitor due to lower labor costs, China’s bar stool factories can reclaim market share by leveraging superior materials (metal, wood, leather, fabric), advanced automation, and higher-quality craftsmanship.

Here’s how Chinese manufacturers can outperform Vietnam and regain dominance in the U.S. bar stool market.

1. Why Vietnam Was Winning—And How China Can Fight Back

**✅ Vietnam’s Previous Advantages**

- Lower labor costs (but rising due to wage inflation)

- Preferential trade policies (now impacted by 20% tariffs)

- Strong wooden furniture production (but weaker in metal bar stools)

**✅ China’s Strengths to Counter Vietnam**

✔ Premium Materials – High-quality metal, wood, leather, and fabric combinations.

✔ Automation & Efficiency – Robotic production lines reduce costs and improve precision.

✔ Superior Finishing & Durability – Better powder coating, welding, and upholstery than Vietnamese factories.

2. How Chinese Bar Stool Factories Can Win Back U.S. Buyers

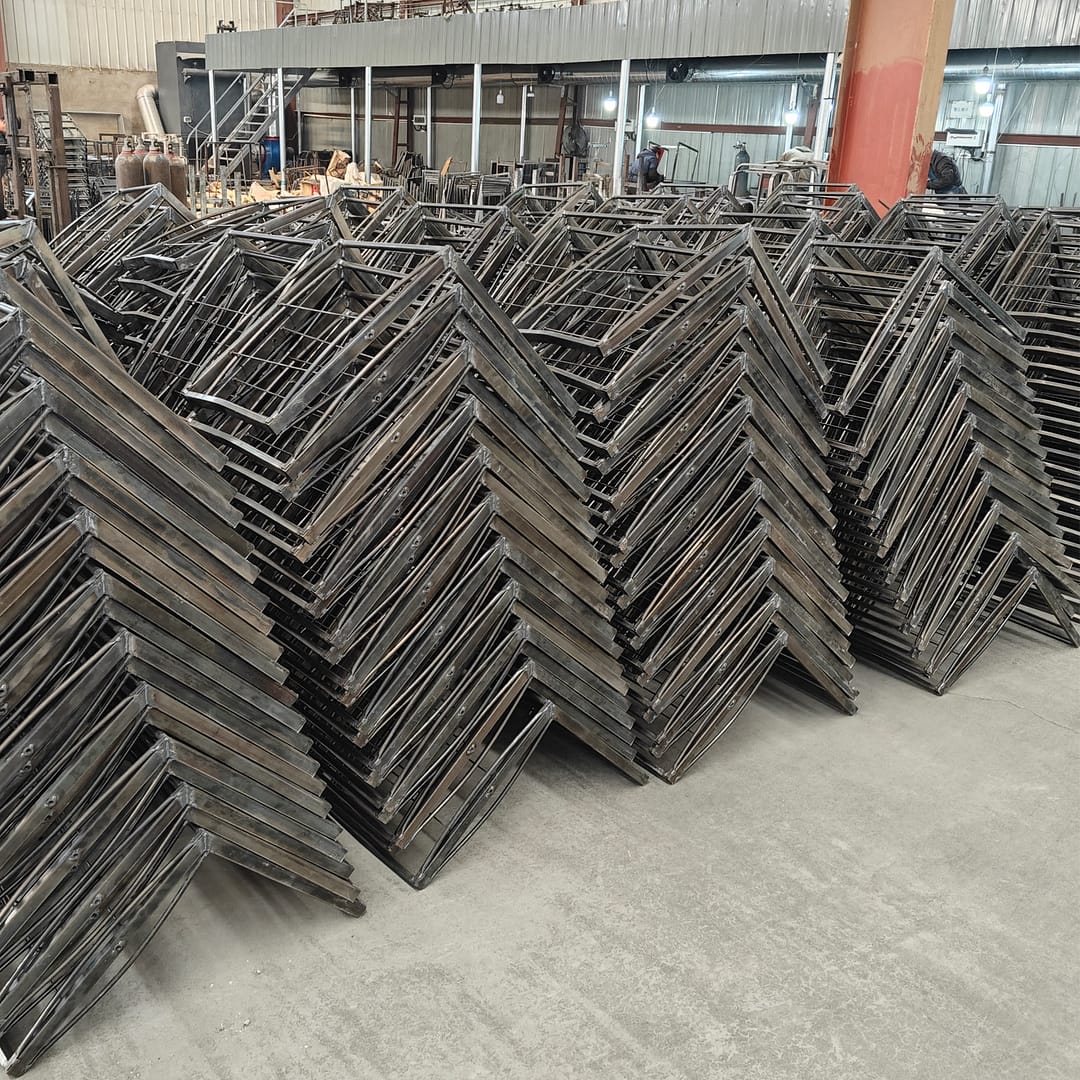

🔹 Focus on High-End Metal Bar Stools (Vietnam’s Weakness)

- Vietnam excels in wooden and rattan furniture, but China dominates in:

- Steel bar stools (industrial, modern styles)

- Iron bar chairs (rust-resistant, heavy-duty)

- Aluminium bar stools (lightweight, outdoor-friendly)

- Promote mixed-material designs (metal + wood, metal + leather, metal + fabric) for higher perceived value.

🔹 Highlight Advanced Manufacturing & Cost Efficiency

- Automated welding & cutting ensures perfectly aligned metal frames.

- Robotic powder coating provides smoother, longer-lasting finishes.

- AI-assisted quality control reduces defects, increasing buyer trust.

🔹 Offer Tariff-Offset Strategies for U.S. Buyers

- Bulk order discounts – Encourage larger shipments to reduce per-unit costs.

- FOB pricing flexibility – Help buyers optimize logistics.

- U.S. warehouse partnerships – Faster delivery, lower shipping costs.

🔹 Emphasize Quality & Customization (Vietnam Can’t Match)

- Hand-stitched leather seats vs. Vietnam’s mass-produced vinyl.

- Precision-cut metal frames vs. Vietnam’s manual welding inconsistencies.

- Custom fabric & color options – U.S. buyers pay more for exclusivity.

3. Marketing Strategies to Attract U.S. Buyers Away from Vietnam

**✔ Target U.S. Buyers Who Value Quality Over Cheap Prices**

- Restaurant chains – Need durable, stylish metal bar stools.

- Luxury hotels & bars – Prefer leather or fabric upholstered stools.

- E-commerce sellers – Want unique designs (Amazon, Wayfair, Overstock).

**✔ Attend U.S. Trade Shows (High Point, Las Vegas Market)**

- Showcase automation advantages (videos of robotic production).

- Offer live customization demos (let buyers pick materials on the spot).

**✔ Strengthen Online Presence with SEO & E-Commerce**

- Optimize for keywords:

- “Best metal bar stools from China”

- “High-quality steel barstools vs. Vietnam”

- “Custom leather bar chairs factory direct”

- List on B2B platforms: Alibaba, Made-in-China, Global Sources.

4. Conclusion: China Can Regain U.S. Market Share

With Vietnam now facing 20% tariffs, Chinese bar stool factories have a golden opportunity to reclaim lost business. By emphasizing:

✅ Superior metal craftsmanship (Vietnam’s weakness)

✅ Automation & efficiency (lower long-term costs)

✅ Premium materials & customization (higher profit margins)

U.S. buyers will recognize that China still offers the best value—even with tariffs.